25/03/2022 New tech, old scams: Don't fall for these crypto and NFT ripoffs

Web3 productslike non-fungible tokensand cryptocurrencies are already changing the world, a shift that blockchain evangelists say will revolutionize how the internet is constructed, how we bank and transfer money, how people pay for goods and even how we socialize in the nascent metaverse.

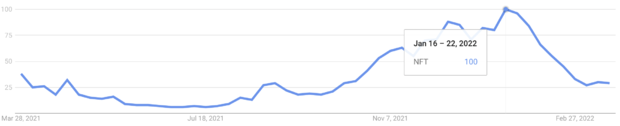

For now, most Americans couldn't care less. Google searches show interest is already cooling in NFTs, bitcoin, decentralized autonomous organizations and other innovations associated with Web3. One reason? Rampant fraud, experts told CBS MoneyWatch.

- You've heard of the metaverse. Here's what it looks like

- Internet guru Tim O'Reilly on Web3: "Get ready for the crash"

Among a string of incidents, hackers swipedNFTs valued at $2.2 millionin January from New York art collector Todd Kramer. A month later at OpenSea — the world's largest NFT market — an estimated $1.7 million worth of NFTs werestolenin an alleged phishing scam. And users of the MetaMask, one of the most popular crypto wallets, routinely reportunauthorized transactions. According to Check Point Research, last fall MetaMask users lost about $500,000 in a targeted phishing attack.

Google search trends for NFTs dropped significantly in early 2022.Google

Google search trends for NFTs dropped significantly in early 2022.Google"The average selling price of NFTs and number of accounts buying and selling NFTs weekly have also dropped," said Anand Sanwal, a tech analyst forCB Insight. "The market's slump is raising questions about the long-term outlook for NFTs, which saw $41 [billion] in sales and an explosion of VC investment in 2021."

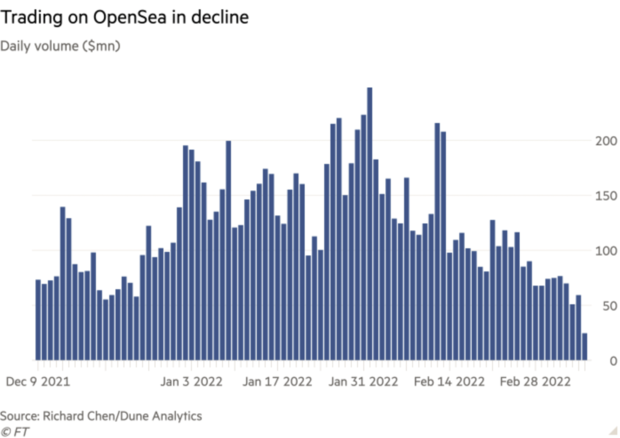

In another sign concerns about fraud are taking a toll, trading volume on OpenSea is down 80% in March from its peak in February, according to theFinancial Times.

Expect the downward trend in NFT trading to continue though 2022, said Dan Ives, a tech analyst at investment firm Wedbush. "It's been a very slow start for the NFT market in 2022 with some major growing pains ahead. Along with a handful of high-profile scams, there has been a black cloud over the NFT market. Some bad actors have clearly taken the bloom off the rose."

NFT trading volume on OpenSea, one of the largest digital asset markets, dropped in early 2022.FT/CB Insights

NFT trading volume on OpenSea, one of the largest digital asset markets, dropped in early 2022.FT/CB InsightsCrypto and NFTs are also confusing and risky, said Molly White, editor of the satirical siteWeb3IsGoingGreat.com, noting that "regulatory agencies have not really cracked down" on the bad actors.

"The hype and noise undermine a lot of the trust most people need to get involved," she added. "The scams are hard to avoid."

"One of the biggest flaws of web3 is the lack of regulation," says@molly0xFFFofhttps://t.co/eqT2FmbVT1pic.twitter.com/I2YjfGnDYg

— Dan Patterson (@DanPatterson)March 8, 2022

If you're thinking about putting money in cryptocurrencies, NFTs or so-called decentralized autonomous organizations (DAO), beware these common scams.

Rug pull

The "rug pull" happens when a startup or influencer promotes a crypto token, NFT or DAO project, solicits public investment, then vanishes with the cash or stops updating the project. To entice investors, these projects often launch on reputable platforms or claimcelebrity involvement. According toChainanalysis, a company that tracks and analyzes blockchain trends, investors lost almost $3 billion to these types of schemes last year.

One if the most notorious examples is the "Squid Game" rug pull. In 2021, a group of developers who were unrelated to the hit Netflix show created a pay to earn crypto-card game. To fund its development, the team asked public investors to purchase a "Squid coin," which at its peak was valued at $2,860. It plunged when the coin's creators abruptly canceled the project, citing "stress," and disappeared with $3.3 million from the wallet.

Such tactics are nothing new, White told CBS MoneyWatch. "It's not even an innovative scam, it just scales well,"she added, noting that potential investors should be wary of small-scale schemes as well as the well-publicized projects. "Sometimes with the smaller projects the same scammers have done [the rug pull] multiple times," White said.

Wash trading

Buying NFTs can be a frustrating experience. Some NFTs sell formillions, while others gather digital dust. And some seem to skyrocket in value for no discernible reason after a flurry of trades.

According to the Chainalysis report, some of that activity comes down to what is known as "wash trading." In that century-old scheme, the buyer and seller of an investment collude to artificially inflate its value and make it appear as though there is significant outside interest. Sometimes the buyer and seller are the same person or business. The practice wasbanned by the Commodity Exchange Act in 1936, and the IRS prohibits taxpayers from deducting losses from wash trading.

With NFTs, the goal of wash trading is to "make one's NFT appear more valuable than it really is by 'selling it' to a new wallet the original owner also controls," Chainalysis said in areport. Because some of the most prominentcrypto-walletsdon't require users to verify their identity, it'srelatively easyto make multiple accounts and simply trade the NFT back and forth.

The report uncovered 262 users that traded NFTs back and forth to self-owned wallets 25 times — 110 of these users made a profit. In total,grifters raked in almost $9 million from wash trading NFTslast year, according to ZDNet.

Pump and dump

Pump-and-dump schemes, long a staple of penny-stock scams, involve artificially inflating an asset's value by making misleading statements and misrepresenting investor demand. These schemes are especially common with small or obscure cryptocurrencies and NFTs that lure investors by touting the opportunity to get in early on a coin that could have big potential later.

Most U.S. states, as well as the federal government, prohibit similarly manipulative stock market scams, but crypto investorslost millions last yearto pump and dump schemes.

"With this scam the people who issue the token get influential people to really talk it up without disclosing they were paid or are part of the project," White said. "The price of the token skyrockets because, you know, 'Kim Kardashian is part of the project and it's gonna be big!' Then they sell off the tokens and people lose interest, and the whole thing plummets back down."

Some allege that scenario appears to be playing out now with EthereumMax, a cryptocurrency promoted by Kardashian that recently shot up in valuation after her endorsement, then quickly tumbled. A group of investors earlier this year filed a class actionlawsuit naming Kardashian, boxer Floyd Mayweather, basketball player Paul Pierce and others, alleging the celebrities received payments to promote the token by claiming early investors could "make significant returns" from purchasing the currency.

(0)

(0)

(0)

(0)