02/08/2024 DraftKings Abruptly Shuts Down NFT Operation, Panicking Collectors With Vast Holdings Of Digital Tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending out an email blast to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play contests in NFL football, PGA Tour golf, and UFC mixed martial arts. The decision to wipe the entire program, says DraftKings, was not made lightly, but was forced "due to recent legal developments."

DraftKings has not yet specified what "recent legal developments" are troubling its now dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, of taking advantage of relatively unsophisticated "retail investors," and of failing to market and support Reignmakers to the degree necessary to return to its users the expected financial benefits. DraftKings filed a motion in September to dismiss Dufoe's complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was shut down for good on July 30. A DraftKings spokesperson contacted by Defector Wednesday declined to confirm whether the Dufoe complaint is the "recent legal development" that forced the company's hand.

Users of the Reignmakers NFL product, who over the last few days had begun to murmur in social channels about a conspicuous lack of DraftKings activity so close to the start of the NFL preseason schedule, were blindsided, and in some cases devastated, by the news. Members of the DraftKings Discord server, where all channels related to Reignmakers were abruptly closed and locked after the announcement, flooded into a general channel in various states of panic, to share news, develop theories, to commiserate, and in some cases to openly fret about whether it would be possible to recoup some decent fraction of the genuinely eye-popping sums of money they'd sunk into this DraftKings product.

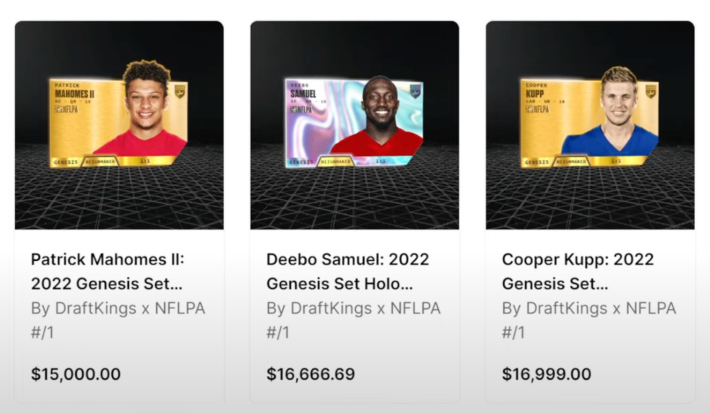

Reignmakers is nominally a daily fantasy contest—users assemble rosters of players and then pit those rosters against the rosters of other users, for cash prizes—but is actually a distributor of non-fungible digital tokens (NFTs), originated and sold by DraftKings, and then often resold on a dedicated secondary marketplace, also hosted on DraftKings. At the roster-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, breathtaking heights. Reignmakers NFTs are sorted into tiers and offered in timed drops, designed to heighten the sense of scarcity. A user can enter a lower-level contest using a collection of NFTs that might've cost in total a couple hundred bucks (or that were gained by purchasing randomized packs of NFTs that offer generally low odds of scoring the top assets), and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Randomized packs at the lowest tier would've had floor prices of a few bucks; mid-level cards—the Star and Elite tiers, I gather—might've run a player upwards of $1,000.

But players interested in hunting the biggest payouts, not just from games but from leaderboard awards and assorted other prizes, would need to get into higher-level games, and in order to get into the higher-level games a user's collection needed to include higher-level NFTs. DraftKings ensured that these cards were vanishingly scarce and could only be purchased outright in the marketplace at prices that any reasonable person would consider entirely insane.

For example, the highest-tier Reignmakers contests (dubbed the Reignmakers tier, natch) have been limited in the past to rosters featuring at least two of the highest-tier and rarest NFTs (also the Reignmaker tier) plus a further three NFTs from the second-highest tier (Legendary). NFTs at these levels are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even a single one of them should trigger a mandatory visit with a gambling addiction counselor, if not sirens and a straitjacket. Backin 2022, a Reignmaker-level Ja'Marr Chase NFT from something called the Field Pass Promo Set could be purchased outright on the DraftKings Reignmaker Marketplace for an astonishing $32,100.

Reignmakers users purchased NFTs at the assorted levels with the expectation that possession of them would convey better odds of winning contests hosted on DraftKings. That was the gamification element of Reignmakers, which came along several months after DraftKings began to market and mint their NFTs. But as with all NFTs, some too-large part of the real appeal to their purchasers was the expectation, however baldly insane, that these pointless and practically useless and infinitely duplicable digital images would grow in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, holders of Reignmakers NFTs are concerned that their investments may suddenly have lost all monetary value. One Discord user described Tuesday as "a bad day to wake up and realize you have $2,000 in unopened NFL Rookie Packs"; another user asked the group whether to expect "a refund" on the $10,000 they've spent on Reignmakers NFTs already this year. A pessimistic Reddit userposted Tuesdaythat they would sue DraftKings if they are forced to swallow a total loss on a Reignmakers NFT collection with a value of approximately $100,000.

The game (scam?) was constructed to make figures like these not just possible, but a little too easily achievable. A user who intended to compete from a position of strength across bunches of overlapping high-level contests at a time, and who was down in the blockchain looney bin for a period of years, could very easily have spent deep into six figures on Reignmakers NFTs. DraftKings used non-game incentives to lure gamers into spending more and more money, in the same way that casinos give free suites to gamblers who wager excessively at blackjack. Another Reddit user lamented the loss of the additional prizes and leaderboard bonuses he expected to gain this upcoming NFL season from having a portfolio of NFTs that had achieved the loftier heights of value and prestige. "I already had loaded up on 2024 crafting tokens and rookie debut cards,"said this Reignmakers user, who claimed his portfolio was finally "close to top 250 overall."

Dufoe's complaint says that the NFTs minted by DraftKings for Reignmakers qualify as securities, function as securities, and ought to be regulated as securities. In its motion to dismiss, DraftKings sought to position its NFTs as game pieces—appallingly expensive ones, yes, but essentially the same thing asMagic: The Gatheringcards orMonopolyhotels. The court, in sorting out these arguments, applied what is referred to as "the Howey test," referencinga 1946 casein which the U.S. Supreme Court established a standard for determining whether a particular instrument qualifies as an investment contract. Judge Denise J. Casper, in ruling against the DraftKings motion, found that Dufoe can plausibly argue that Reignmakers NFT transactions represent "the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise," reasoning that DraftKings' absolute control over both the game and the marketplace effectively tie together the financial interests of both the company and purchasers, the latter of whom depend upon the viability of both in order for their NFTs to retain any value whatsoever.

Reignmakers users are different fromMonopolyplayers in at least one crucial regard: A person who buys aMonopolyboard has been given no expectation by Hasbro that those little red and green pieces will appreciate in value. It's a game! Whatever any hysterically conflicted parties bleat to the contrary, NFT collection extremely is not that. DraftKings sold Reignmakers NFTs for months before they were ever gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets of independent monetary value, apart from their utility in Reignmakers contests. Judge Casper, in her decision on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings president Matthew Kalish, which in a tweet described NFTs as "the opportunity to invest in startups, artists, operations and enterpreneurs all at once." Probably this is the sort of thing that NFT hucksters ought to stop saying. This advice presumes, of course, that NFTs continue to exist as instruments on the other side of this and other lawsuits.

DraftKings posted a worryingly sparse FAQ at the bottom of its announcement Tuesday, anticipating but broadly failing to answer the questions of players who view this as another in a long line of brutal blockchain rug-pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now permitted by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There is also vague language about Reignmakers users being given the option to "relinquish" their NFTs back to DraftKings in exchange for "cash payments," subject to "certain conditions," and according to an as-yet-unspecified formula that will take into account, among other things, the "size and quality" of a player's collection.

Reignmakers users are not optimistic. Those who say they've been victimized by other blockchain market collapses are warning their fellows on Discord and Reddit to expect payouts amounting to pennies on the dollar; in the absence of clarifying information, users are unsure whether withdrawing their Reignmakers NFTs to their personal NFT wallets, for reasons entirely passing any and all understanding, would effectively foreclose on the possibility of relinquishing these dumb digital tokens back to DraftKings. It remains to be seen what precisely DraftKings has in mind with the "certain conditions" attached to the relinquishing process. There's a lot that is still unresolved. The DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions, and issued a statement noting that it is "in DraftKings’ DNA to innovate and disrupt in order to provide the best possible gameplay experiences for our customers." The original complaint is embedded below.

(0)

(0)

(0)

(0)