18/11/2022 Do You Owe Taxes on Your NFT?

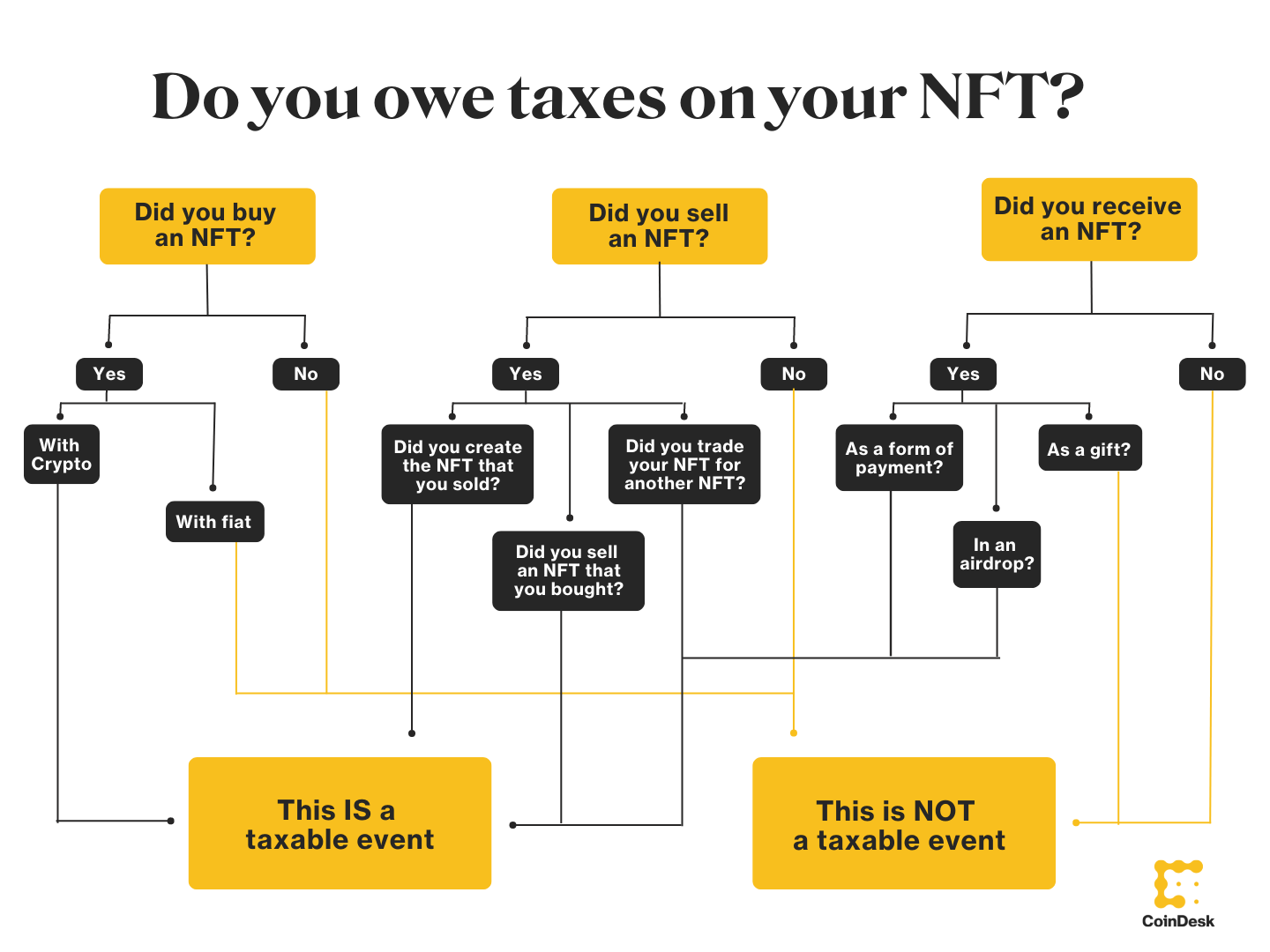

Here are the NFT-related rules of thumb to consider when filing your 2022 taxes.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/A5UHHGWUXFH4LBRTVXGSYI5HVY.jpg)

To date in 2022, the NFT market has seen more than 8.61 ETH in trading volume across 2.7 million wallets. According to CoinMarketCap, the sector’s total market cap amounts to over $13 billion. And yet, despite the industry’s astronomical size and continued growth, there remains a lack of clarity around NFT taxation for both creators and collectors alike.

For the 2022 tax year, the Internal Revenue Service updated Form 1040 and replaced the term “virtual currency” with “digital assets,” a broader label to encompass both NFTs and cryptocurrencies. The IRS treats digital assets as property, meaning they are subject to capital gains tax rates.

While the guidance remains somewhat murky, below are the general NFT-related rules of thumb to consider when filing your 2022 taxes in the U.S. Note that there is not yet any official guidance from the IRS on commissions orroyalties received from downstream NFT resales, but they would most likely be considered income.

(CoinDesk)

(0)

(0)

(0)

(0)

https://www.coindesk.com/learn/do-you-owe-taxes-on-your-nft/